casestudyguru.com

Home

Peter Lynch (Index)

Sun Distributors

1991-1993

Industry: Autoparts and Glass

Category: Special Situation

Context

Sun Distributors is a roll-up of 36 auto parts and glass companies.

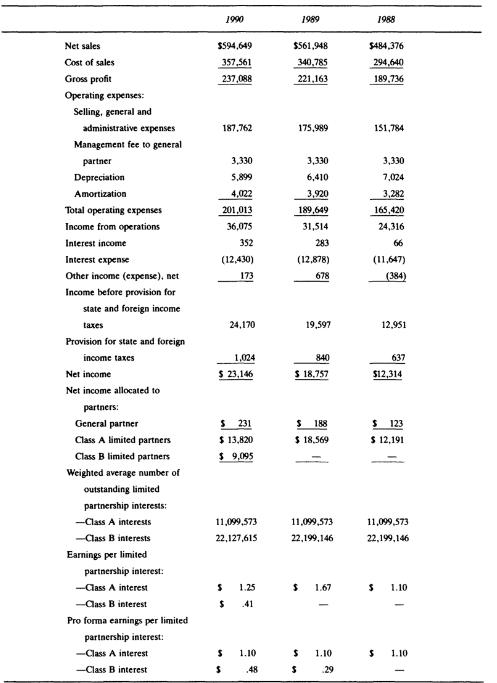

The business is profitable,

has the highest gross profit in the industry (implying it's a low cost operator),

and requires little maintenance capex.

Why the Company is Mispriced

Sun Distributors is set up as a Master Limited Partnership (MLP).

In exchange for distributing all of it's earnings directly to shareholders as a dividend,

the company does not have to pay taxes on a certain percentage of it's distributions.

MLPs are unpopular because it reminds people of the LP boondoggles of the past.

Often the tax advantage feature was used as a sales tool to sell bad assets.

The combination of the association with LPs and an additional tax form dissuaded many from MLPs.

Sun Distributors also had a complicated capital structure - it had 2 classes of shares, A and B.

Class A has a big dividend and management are required to eventually buyback the shares at $10. The Class A shares trade for $10/sh.

Class B has no dividend, but are entitled to the remaining value of the company after all the Class A shares are bought back. The Class B trade for $2/sh.

Finally, the company had intangible amortization from it's acquisitions, creating a large discrepancy between the company's reported earnings and FCF.

Alternative View

According to changes in laws, all non-real estate and mining MLPs must be closed out by 1997-1998. Starting 1998, MLPs will no longer be tax advantaged.

Therefore, the entire enterprise may be sold off in 1997.

When the enterprise is sold off, Class A shares receive $10/sh.

Class B shares receive the remaining value. Lynch estimates this value to be $5-8/sh.

Management is highly incentivized to realize this value since Shearson Lehman owns 52% of the Class B shares,

and management has an option to buy 1/2 of the 52% at a fixed price.

Furthermore, alll FCF resulting from acquisition amortization ultimately flows into Class B's intrinsic value, not the Class A dividend.

Lynch estimated that the company was theoretically bringing in $1/sh in FCF to the Class B's intrinsic value.

In summary, Class B shares were trading at $2/sh, shareholders should receive $5-8/sh by 1997, and that intrinsic value grows by $1/sh every year.

Result

In 1993, management announced it's plan to sell various divisions.

This moved the class B share price to $4.4/sh, a 120% return, or a 30% CAGR.

Lynch felt that the company was premature in selling it's assets, that it would've been better off delaying until 1997.